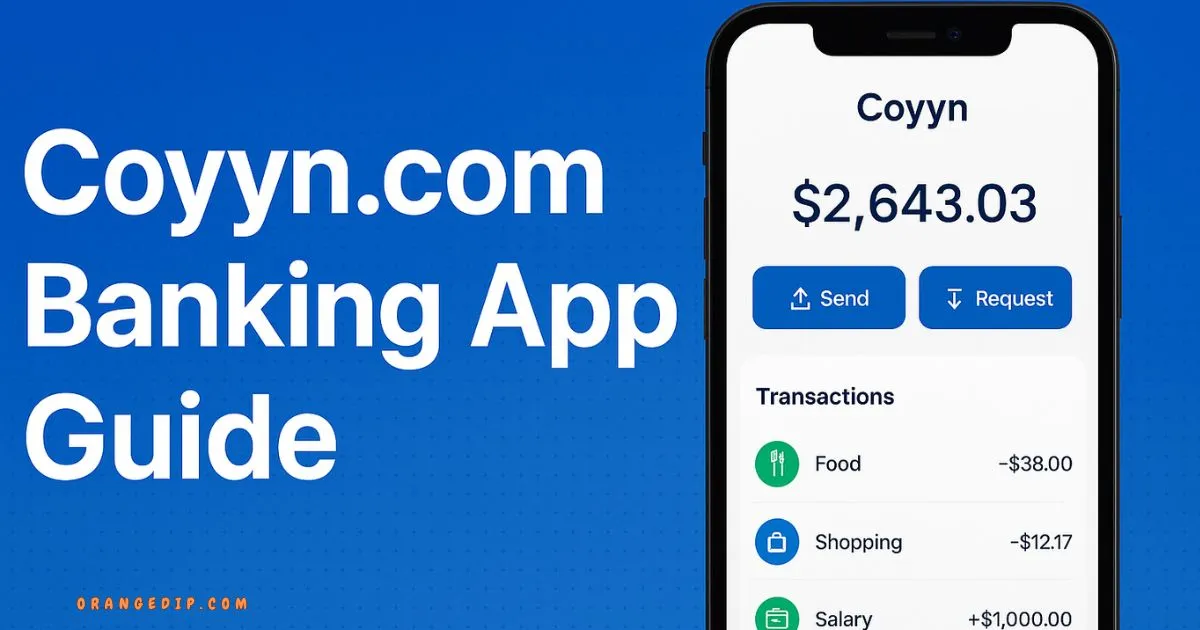

Introduction

The Coyyn Banking App is part of a new wave of digital-first finance tools designed to make managing money faster, simpler, and smarter. Instead of juggling multiple accounts or wallets, Coyyn promises one platform for everyday banking, payments, and even digital-asset support. In a world where most people now prefer mobile banking over traditional branch visits, Coyyn stands out for its clean design, speed, and focus on secure transactions.

This guide gives you everything you need to know — what Coyyn is, how to set it up, its main features, security tips, and practical usage advice. The goal is to help you understand how it works and decide if it fits your financial needs. You’ll also find FAQs based on real user queries to ensure you start with confidence and stay safe while using the app.

What is the Coyyn Banking App?

Coyyn is a mobile banking and digital wallet platform that integrates traditional money management with modern fintech capabilities. It aims to make banking more accessible for individuals, freelancers, and small businesses.

Instead of logging into separate apps for bank accounts, transfers, and crypto wallets, Coyyn brings them together in one interface. Through its app, users can check balances, transfer funds, pay bills, and manage different types of assets, all while maintaining control through secure, encrypted connections.

Core Purpose

The primary goal of Coyyn is to simplify digital finance for everyday users — offering convenience, flexibility, and control over personal or business transactions. It seeks to reduce the time spent handling money, improve transaction speed, and provide financial insights in real time.

Who It’s Designed For

-

People who prefer mobile banking over visiting branches.

-

Freelancers or gig-economy workers managing multiple income streams.

-

Users who transact across borders or hold digital assets.

-

Tech-savvy individuals seeking an all-in-one finance app.

Main Features of the Coyyn Banking App

1. Mobile Account Access

Coyyn gives users instant visibility into balances, recent transactions, and spending analytics. You can manage your money anywhere, anytime, without relying on physical bank offices.

2. Wallet Integration

Unlike traditional banks, Coyyn allows users to maintain digital wallets that support both fiat currencies and selected digital assets. This dual functionality makes it easier for users to handle both everyday banking and newer digital payment options.

3. Payments and Transfers

The app focuses on speed and simplicity. Transfers between Coyyn users are typically instant, while external bank transfers are streamlined through integrated payment gateways. Many users value its straightforward interface for paying bills and sending money internationally.

4. 24/7 Banking

As a fully digital platform, Coyyn never “closes.” You can transfer funds, review history, or adjust settings anytime. This always-on availability suits global users who work across time zones.

5. Budgeting and Analytics Tools

Built-in tools show where your money goes each month. Users can categorize transactions, set savings goals, and receive alerts to help control expenses and manage income better.

6. Multi-Currency Support

Coyyn aims to support multiple major currencies. This helps users who earn or spend across borders avoid complicated conversions and delays.

7. User-Friendly Interface

The design of Coyyn is deliberately minimalistic. All key functions — balance, transfer, pay, wallet — are available from the home screen. This design choice helps reduce confusion, especially for first-time fintech users.

How to Download and Set Up the Coyyn Banking App

Getting started with Coyyn takes only a few minutes. Follow this step-by-step guide:

-

Download the Official App

-

Open your phone’s App Store or Google Play Store.

-

Search for “Coyyn Banking App”.

-

Verify that the developer name matches Coyyn before downloading.

-

-

Install and Launch the App

-

Tap “Install.”

-

Once installed, open the app and select Create Account.

-

-

Register Your Account

-

Enter your full name, email address, and mobile number.

-

Create a strong password using a mix of letters, numbers, and symbols.

-

Accept the user agreement and privacy policy.

-

-

Verify Your Identity (KYC)

-

Upload a clear photo of a valid government ID (passport, ID card, or driver’s license).

-

Take a quick selfie for facial verification if prompted.

-

Submit and wait for approval (usually within minutes to a few hours).

-

-

Link Your Funding Source

-

Add a debit/credit card or connect your existing bank account.

-

For crypto features, set up or connect your digital wallet.

-

-

Activate Security Features

-

Turn on two-factor authentication (2FA).

-

Set a PIN or enable biometric login (fingerprint/face ID).

-

Avoid sharing passwords or codes with anyone.

-

-

Start Using the App

Once your profile is verified, you can check your balance, send money, receive funds, and manage assets.

Security and Privacy: What to Know Before Using Coyyn

When using any mobile banking service, security is the top priority. Coyyn incorporates standard financial-grade protections, but users must also do their part.

Security Highlights

-

Data Encryption: All transactions and personal information are encrypted end-to-end.

-

Biometric Login: Face or fingerprint unlock ensures only you access your account.

-

Two-Factor Authentication: Extra protection against unauthorized logins.

-

Fraud Monitoring: The system continuously scans for unusual activity.

User Safety Tips

-

Never install the app from unofficial sources or third-party websites.

-

Regularly update your app to receive the latest security patches.

-

Avoid using public Wi-Fi for financial transactions.

-

Keep backup recovery options active and up to date.

Regulatory Transparency

Before storing large sums, confirm the regulatory standing of Coyyn in your country. Make sure it operates through licensed banking or e-money partners. As a newer fintech service, Coyyn continues to expand its compliance frameworks.

Pros and Cons of the Coyyn Banking App

Advantages

-

All-in-One Solution – Combines banking, payments, and digital wallets.

-

Fast Transactions – Minimal waiting time for transfers and payments.

-

User-Friendly Design – Simple navigation even for beginners.

-

Global Access – 24/7 app functionality without geographical restrictions.

-

Budget Tools – Built-in expense tracking and goal management.

Possible Limitations

-

Newer Platform – Less historical data and fewer long-term user reviews.

-

Regulatory Clarity – Users should verify local licensing and protection schemes.

-

Support Delays – As with many new fintechs, customer-support response times can vary.

-

Regional Restrictions – Some currencies or payment types might not yet be available everywhere.

-

Learning Curve for Crypto Users – Wallet functions may require understanding basic digital-asset concepts.

Best Practices for Using Coyyn Efficiently

-

Start Small – Begin with a modest balance until you fully understand the system.

-

Enable Notifications – Get instant alerts for logins and transactions.

-

Review Statements Monthly – Keep track of your inflows and outflows for better financial awareness.

-

Separate Personal and Business Funds – If you freelance or run a small business, create separate wallets.

-

Stay Updated – Fintech services change rapidly; read app announcements for new policies or features.

-

Regular Security Checks – Change your password every few months and review connected devices.

-

Keep Proof of Transactions – Screenshots or receipts can help resolve disputes.

Common Issues and Troubleshooting

-

Login Errors: Reset your password through the app. Ensure your phone’s date/time are accurate.

-

Verification Delays: Retry with clearer ID photos and ensure your name matches your documents.

-

Transfer Not Showing: Wait for the transaction confirmation; contact support if funds remain pending after 24 hours.

-

Failed Card Linking: Double-check card details and that online payments are enabled by your bank.

-

App Crashes: Update to the latest version or reinstall the app.

Most problems are minor and resolve after updates or basic verification checks.

Who Should Consider Coyyn?

Coyyn is best suited for:

-

Young professionals who handle all banking digitally.

-

Freelancers paid through online platforms or multiple currencies.

-

Travelers or remote workers managing international transfers.

-

Crypto-curious users who want both fiat and digital wallets in one place.

Those who rely heavily on in-person service or require government-insured deposit protection might still prefer established banks for large savings accounts.

FAQs

1. How do I download and install the Coyyn Banking App?

Go to the App Store (iOS) or Google Play (Android), search for “Coyyn Banking App,” verify it’s the official developer, and install. Follow on-screen prompts to register.

2. How do I open and verify my Coyyn account?

After installing, tap “Create Account,” fill in your details, and upload ID documents for verification. Once approved, you can start using all features.

3. Is the Coyyn app safe for storing money?

Coyyn uses encryption, biometric login, and fraud detection to keep funds secure. Still, treat it like any digital wallet: enable 2FA and avoid storing large balances unless fully confident in its regulation.

4. Can I use Coyyn for international transfers?

Yes. Coyyn supports multi-currency transactions and aims to make cross-border payments easier. Check your country’s availability and fees before sending.

5. What should I do if my transaction fails or is delayed?

First, check your internet connection and verify transaction details. If the issue persists, contact Coyyn support through the app and keep your transaction ID handy.

Read More: BottleCrunch.com Your Smart Guide to Web Hosting and Server

Conclusion

The Coyyn Banking App brings together convenience, modern design, and flexibility for users who prefer full control of their finances on a single platform. By combining traditional money management with wallet and digital-asset capabilities, it reflects the future of everyday banking. While it provides speed and usability, users must approach it responsibly — verifying local regulations, enabling strong security settings, and starting with smaller balances.

Coyyn shows great potential as a streamlined digital-banking solution for the mobile generation, freelancers, and global users. If you value time, simplicity, and innovation, Coyyn can fit well into your financial routine. However, as with any fintech platform, stay informed, secure your data, and always manage funds wisely to enjoy a smooth and safe banking experience.