Navigating the world of investments can feel like steering through a storm without a compass. With so many options—stocks, forex, commodities, or ETFs—making the right decision can be overwhelming. That’s where FTAsiaTrading comes into play, offering resources, insights, and strategies for traders looking to grow their wealth thoughtfully and responsibly. In this article, we’ll explore practical investment tips, share a real-world scenario, and even provide a comparison table to make your decisions clearer.

Understanding the Basics: Why Strategy Matters

Before diving into specific tips, it’s essential to understand why having a strategy is critical. Trading without a plan is like trying to bake a cake without a recipe—you might get lucky, but consistent results are unlikely. An investment strategy helps you define:

-

Your financial goals: Are you saving for retirement, a home, or building a trading portfolio?

-

Risk tolerance: How much volatility can you handle without panic-selling?

-

Time horizon: Short-term trades differ from long-term investments in approach and mindset.

I personally learned this the hard way early in my trading journey; trying to chase quick gains without a clear plan led to more losses than wins. Since then, disciplined planning has transformed the way I approach markets.

Top Investment Tips for FTAsiaTrading Users

Here are some actionable tips for traders at any level, curated with both experience and FTAsiaTrading insights in mind:

1. Diversify Your Portfolio

Putting all your capital into a single asset is risky. Diversification across asset classes—stocks, ETFs, commodities, and currencies—can reduce overall risk. For example, combining tech stocks with stable government bonds can balance growth and safety.

2. Embrace Risk Management

Use stop-loss orders to protect your capital and never invest more than you can afford to lose. FTAsiaTrading emphasizes the importance of calculating position size and managing leverage, especially in volatile markets.

3. Keep Learning and Researching

Markets evolve constantly. Reading financial news, analyzing charts, and following economic indicators can give you an edge. FTAsiaTrading provides tutorials, webinars, and market insights to help traders stay informed.

4. Focus on Long-Term Growth

While day trading can be enticing, long-term investments generally offer more stable returns. Consider assets with strong fundamentals and growth potential. For instance, tech or green energy sectors often yield steady growth over years.

5. Monitor Emotional Bias

Fear and greed are powerful motivators. Emotional trading often leads to impulsive decisions. Keeping a trading journal, tracking successes and failures, and reviewing performance periodically can help mitigate these biases.

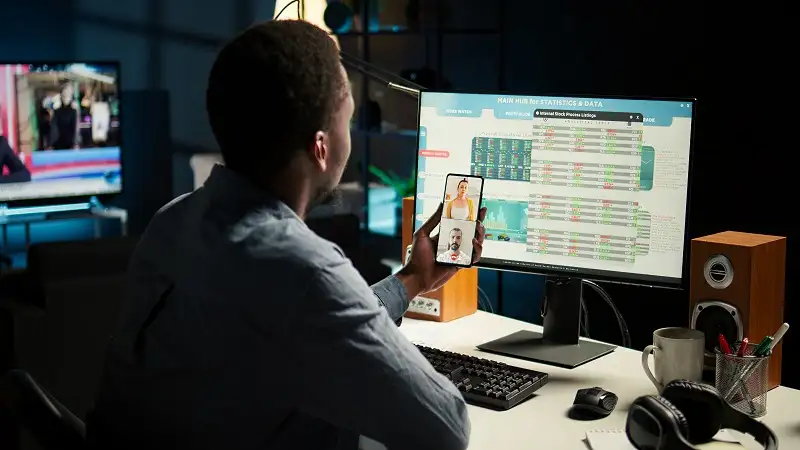

Applying FTAsiaTrading Insights for Portfolio Growth

Consider a trader named Sarah who recently joined FTAsiaTrading. She wanted to grow her savings but felt intimidated by market volatility. By following a structured investment plan, she diversified her portfolio with blue-chip stocks, ETFs, and a small allocation in emerging-market funds. Using FTAsiaTrading’s market insights, she learned to set realistic stop-loss levels and review her portfolio weekly. Over 12 months, Sarah’s disciplined approach yielded consistent growth, illustrating the power of informed, strategic trading.

Comparison Table: Short-Term vs Long-Term Investment Strategies

| Feature | Short-Term Trading | Long-Term Investment |

|---|---|---|

| Time Horizon | Days to months | Years |

| Risk Level | High | Moderate to low |

| Research Focus | Technical analysis | Fundamental analysis |

| Potential Returns | Fast but unpredictable | Gradual but steady |

| Emotional Impact | Stressful | Less stressful |

| Ideal for | Active traders | Passive investors |

This table highlights why combining short-term and long-term approaches can create a balanced, resilient portfolio.

Unique Value in Using FTAsiaTrading

What sets FTAsiaTrading apart is its focus on education-driven trading. Unlike platforms that emphasize speed and hype, FTAsiaTrading prioritizes knowledge, risk management, and long-term success. For example, new traders can access interactive tutorials and live webinars, while experienced traders benefit from in-depth analysis and professional insights. This blend ensures everyone, regardless of experience, can make informed decisions.

Read More: Business Advice onPressCapital Insights & Tips

Conclusion

Investing wisely is more than picking the right stocks—it’s about strategy, discipline, and continuous learning. By implementing these investment tips with FTAsiaTrading, you can navigate markets with confidence, reduce unnecessary risks, and steadily grow your portfolio. Remember, trading is a journey, not a sprint. Patience, informed decisions, and consistency are your most powerful tools.

FAQs

1. Is FTAsiaTrading suitable for beginners?

Absolutely. FTAsiaTrading provides educational resources, tutorials, and market insights that are beginner-friendly, making it easier to start trading responsibly.

2. How do I manage risk effectively?

Use stop-loss orders, diversify your portfolio, and never invest more than you can afford to lose. Regularly reviewing your strategy helps control risk.

3. Should I focus on short-term or long-term investments?

Both approaches have merit. Short-term trading offers quick gains but higher risk, while long-term investing provides steady growth and lower stress.

4. How often should I review my investments?

Weekly or monthly reviews are recommended. Evaluate performance, market trends, and adjust strategies as needed.

5. Can FTAsiaTrading help with market research?

Yes. The platform offers tutorials, webinars, and analytical tools that help traders stay updated on market trends and make informed decisions.